16 August, 2023

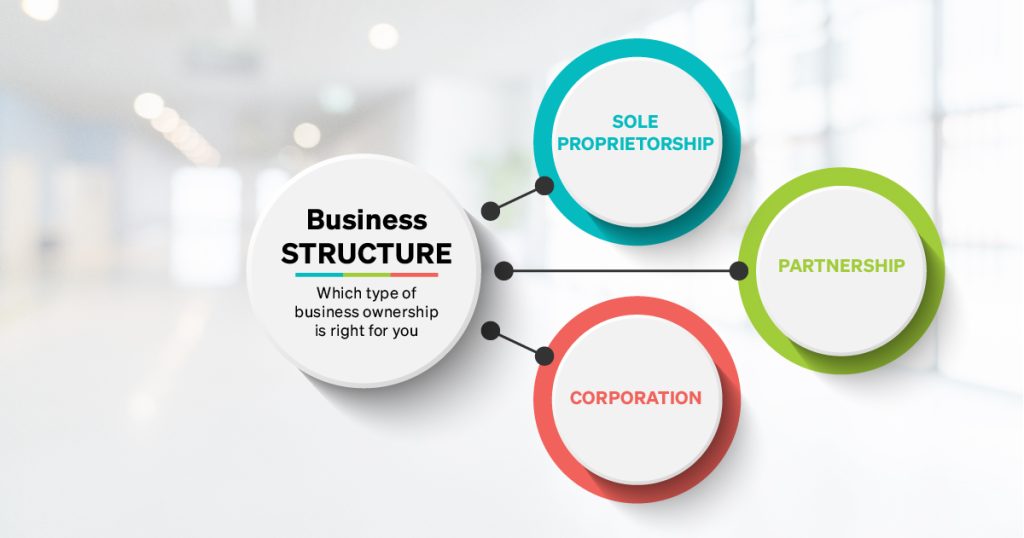

When one creates a business they are typically formed as a corporation, a sole proprietorship, or a partnership. What are the differences of each type of business structure, and which is best?

Sole proprietorship

Entrepreneurs starting a new business might operate as a sole proprietor. This is the simplest approach. The business needs to register its name and obtain a business number from the CRA. Of course when choosing a business name in any business form one should make sure the name is not confusingly similar to an existing name or trademark.

| PROS | CONS |

| Business losses can be deducted from other non-business income. | The individual is personally liable for business costs, losses and legal risks. |

| Inexpensive to set up and maintain. | Doesn’t work for multiple owners. |

| Not perceived as sophisticated. |

Partnership

A partnership is a business operated by more than one individual acting together — although the term is often misused in the legal sense. The Ontario Partnerships Act says “Partnership is the relation that subsists between persons carrying on a business in common with a view to profit…” The partners should sign a partnership agreement to document their arrangement. (This post describes a typical partnership, not limited liability partnerships that are available to some professionals.)

| PROS | CONS |

| Relatively easy to set up. | Each partner is personally liable for all partnership costs, losses, and legal risks — not just their ownership share. |

Corporation

Incorporation is the most common business structure. A business starting as a sole proprietorship might incorporate as soon as it makes money and can no longer offset losses against other income. A corporation is considered a legal entity that can own property and act just like a person. A corporation can have multiple owners who are shareholders, not partners.

| PROS | CONS |

| Liability is limited to the assets of the corporation, not the shareholders. | Can’t offset losses against other income when in startup mode. |

| Perceived as sophisticated. | More expensive to set up and maintain. |

| Tax advantages. |

Which business structure is best?

In most situations, a corporation is the best way to carry on a business. But other forms can have advantages depending on the situation.

David Canton is a business lawyer and trademark agent at Harrison Pensa with a practice focusing on technology, privacy law, technology companies and intellectual property. Connect with David on LinkedIn and Twitter.